In recent years, the Philippines has seen a significant rise in the popularity of home-based businesses, spurred by shifts in the global economy and the increasing need for flexible, alternative income sources. These ventures range from digital freelancing and e-commerce to artisanal crafts and local services, reflecting a diverse landscape of opportunities that cater to a variety of skills and market demands.

For many aspiring entrepreneurs, however, accessing the necessary startup capital remains a challenge, particularly for those who are unemployed and lack a traditional bank account. This is where specialized financial products such as online loan no credit check instant approval philippines come into play. These loans are designed to provide critical support to individuals eager to start their own business but who find themselves outside the conventional banking system.

Mikka Montero, a renowned financial expert, offers valuable insights on navigating these financial solutions effectively. She emphasizes the importance of understanding and choosing the right financial products to support burgeoning home enterprises, ensuring that entrepreneurs not only launch their businesses but also sustain them successfully. For further guidance, platforms like allthebestloans.com are invaluable, offering comprehensive comparisons of financial products tailored to the unique needs of home-based business owners. These resources enable individuals to make informed decisions, matching them with the best tools to foster their entrepreneurial ambitions.

Overview of Home-Based Business Trends

The rise of home-based businesses in the Philippines has been influenced by several key factors, reflecting broader global trends as well as local economic conditions. This surge is primarily driven by increased internet penetration, the desire for flexible work schedules, and the necessity created by unemployment. Each factor contributes uniquely to the growing appeal of operating a business from home.

Factors Driving the Rise

- Increased Internet Penetration: The widespread availability of affordable internet has been pivotal. It allows more people to access online platforms and tools necessary for running a business from home. This digital connectivity is crucial for tasks ranging from marketing and sales to communication with customers and suppliers.

- Desire for Flexible Work Schedules: Many individuals are seeking better work-life balance, which home-based businesses can provide. This flexibility is especially appealing to those with family obligations or those who prefer to work outside the traditional 9-to-5 hours.

- Necessity Due to Unemployment: With fluctuating job markets and high unemployment rates, many have turned to home-based businesses as a vital source of income. This trend has been particularly pronounced during economic downturns, where traditional job opportunities are scarce.

Popular Sectors for Home-Based Businesses

- E-commerce: Online stores have become incredibly popular, allowing entrepreneurs to sell products directly to consumers without the need for a physical storefront. This sector ranges from selling handmade goods to reselling commercial products.

- Freelance Digital Services: The demand for digital services—such as graphic design, web development, content writing, and digital marketing—has grown exponentially. Freelancers can offer their skills to a global client base, all from the comfort of their homes.

- Artisanal Crafts: There is a significant market for unique, handmade products. Artisans and crafters can leverage online marketplaces and social media platforms to reach customers interested in purchasing bespoke items ranging from jewelry and clothing to art and home decor.

These sectors illustrate the diverse opportunities available for home-based entrepreneurs. By capitalizing on these trends, individuals can create sustainable businesses that not only meet their personal and financial needs but also contribute to the broader economy. This shift towards home-based enterprises is likely to continue as technology advances and more people seek out the autonomy and flexibility that such ventures offer.

Financial Tools and Resources for Home-Based Entrepreneurs

For home-based entrepreneurs, accessing the right financial tools and resources is crucial to launching and sustaining their business ventures. Various financing options are available, each suited to different types of businesses and their specific needs. Platforms like allthebestloans.com play a vital role in helping entrepreneurs navigate these options by providing comprehensive comparisons and guidance.

Types of Financial Tools

- Microloans: These are small loans typically aimed at startups and small businesses that may not qualify for traditional bank loans. Microloans are ideal for entrepreneurs who need a modest amount of capital to get started or to fill a cash flow gap.

- Crowdfunding: This method involves raising small amounts of money from a large number of people, typically via the Internet. Crowdfunding is popular among entrepreneurs who wish to test the market with innovative products or projects and can also serve as a marketing tool.

- Government Grants: Some government programs offer grants to support small businesses, particularly those in specific industries or owned by individuals from certain demographic groups. Grants are highly sought after as they do not require repayment.

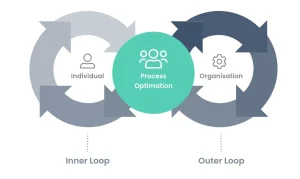

Guidance from Platforms like allthebestloans.com

Platforms like allthebestloans.com offer invaluable assistance to entrepreneurs by providing detailed information on various financial products. These platforms help users:

- Compare different types of loans, crowdfunding options, and grants based on factors such as interest rates, eligibility criteria, and repayment terms.

- Understand the advantages and potential drawbacks of each financial tool, enabling informed decision-making.

- Navigate the application processes for these financial products, providing step-by-step guidance and expert tips.

Overview of Financial Tools for Home-Based Entrepreneurs

| Financial Tool | Purpose | Benefits | Considerations | Typical Providers |

| Microloans | Small startup or expansion costs | Accessible, low-interest rates | Limited amounts, may require credit history | Microfinance institutions |

| Crowdfunding | Product launching or expansion | Market validation, no repayment required | Must reach full funding goal to receive money | Kickstarter, Indiegogo |

| Government Grants | Specific projects or growth | No repayment required, supports specific sectors | Competitive, strict eligibility | Local government agencies |

| Personal Savings | All business needs | No debt incurred, total control | Limited by available personal funds | N/A |

| Investor Funding | Large scale expansion | Large amounts possible, business expertise | Equity given up, investor involvement | Angel investors, venture capitalists |

| Trade Credit | Inventory purchase | Delayed payment terms, improve cash flow | Must be established, terms vary | Suppliers, vendors |

This comprehensive view helps entrepreneurs choose the right financial tools to support their business goals, enhancing their ability to successfully manage and grow their home-based enterprises. With the right guidance and resources, even individuals without traditional banking access can secure the necessary funding to thrive in today’s competitive market.

Challenges and Solutions for Home-Based Business Owners

Operating a home-based business comes with a unique set of challenges. From dealing with market saturation to navigating logistics and managing limited capital, entrepreneurs must be strategic and resourceful. Here, we explore common issues faced by home-based business owners and provide practical solutions, including expert advice from Mikka Montero on maintaining financial health and using loans wisely.

Common Challenges

- Market Saturation: Many home-based business sectors are highly competitive, with numerous entities offering similar products or services.

- Logistics Management: Managing inventory, shipping, and handling returns can be particularly challenging without the infrastructure typically available to larger businesses.

- Capital Limitations: Limited access to capital can hinder the ability to stock up on inventory, invest in marketing, or expand operations.

Practical Solutions

- Differentiating the Business:

- Solution: Focus on carving out a niche by offering unique products or personalized services that set your business apart from competitors.

- Mikka Montero’s Advice: “Identify and emphasize what makes your business unique. Whether it’s a product innovation, customer experience, or a specific market focus, differentiation is key to standing out in a crowded market.”

- Improving Logistics:

- Solution: Utilize third-party logistics (3PL) providers to manage inventory and shipping. Invest in software solutions that streamline order processing and tracking.

- Mikka Montero’s Advice: “Explore partnerships with reputable logistics companies that can scale with your business needs. Effective logistics management can significantly enhance customer satisfaction.”

- Accessing Adequate Funding:

- Solution: Consider various financing options such as microloans, crowdfunding, or “loans for unemployed with no bank account Philippines” for those with limited access to traditional banking services.

- Mikka Montero’s Advice: “Use loans wisely—target these funds towards high-return aspects of your business such as product development or market expansion. Always plan your repayment strategy before taking on debt.”

Leveraging Technology

- Solution: Adopt technology solutions that help manage business operations efficiently, such as accounting software, customer relationship management (CRM) systems, and e-commerce platforms.

- Mikka Montero’s Advice: “Invest in technology that automates routine tasks, freeing up your time to focus on strategic growth activities. Technology is not just an operational expense; it’s an investment in your business’s efficiency and scalability.”

Building a Financial Safety Net

- Solution: Maintain a reserve fund or line of credit to manage cash flow during slow business periods.

- Mikka Montero’s Advice: “Always have a financial buffer to protect your business from unforeseen expenses. This is crucial for maintaining operations and safeguarding your personal financial health.”

By addressing these challenges with thoughtful strategies and expert guidance, home-based business owners can enhance their operational efficiency, foster growth, and sustain their ventures over the long term.

Future Outlook

The landscape of home-based businesses in the Philippines is rapidly evolving, influenced by a confluence of technological advancements and shifts in consumer behavior. These trends not only shape the current market dynamics but also forecast a transformative path for future entrepreneurs. Here, we explore these trends and predict how they might create new opportunities for both aspiring and established home-based business owners.

Technological Advancements

- E-commerce Platforms: The continued enhancement of e-commerce technology is making it easier for home-based businesses to reach wider markets. Platforms are becoming more user-friendly, incorporating advanced features like AI-driven customer service bots, personalized marketing tools, and integrated payment systems.

- Digital Fabrication: Technologies such as 3D printing are becoming more accessible, enabling home-based businesses to produce bespoke or custom-designed products at a lower cost and on a smaller scale without needing large factories.

- Remote Work Tools: As remote work becomes more normalized, tools that facilitate collaboration and project management will become increasingly crucial. This trend will support home-based business owners in managing teams and projects effectively, irrespective of geographical boundaries.

Changes in Consumer Behavior

- Preference for Local and Artisanal Products: There is a growing consumer preference for locally-made and artisanal products, driven by a desire to support local economies and a shift towards more sustainable consumption practices. Home-based businesses that offer unique, handcrafted goods are likely to benefit from this trend.

- Increased Demand for Personalized Services: Consumers are increasingly looking for personalized experiences and services that cater specifically to their needs. Home-based businesses can leverage their agility to offer tailor-made solutions more effectively than larger corporations.

- Health and Wellness: The rising awareness of health and wellness is prompting more consumers to seek products that promote a healthy lifestyle. Home-based businesses focusing on health foods, wellness products, and related services are likely to see growth in this sector.

Predictions for Home-Based Entrepreneurs

- Growth in Niche Markets: Entrepreneurs who focus on niche markets or specialized products will find ample opportunities as consumers increasingly look for items that stand out from mass-produced goods.

- Integration of Advanced Technologies: Small businesses will increasingly adopt advanced technologies like AI and machine learning to analyze consumer data, predict trends, and personalize offers, which will enhance their competitive edge.

- Sustainability as a Key Differentiator: With the growing emphasis on environmental impact, businesses that demonstrate sustainability in their operations and products will attract more customers and potentially command premium pricing.

The future for home-based businesses in the Philippines looks promising, with multiple avenues for growth and innovation. By staying attuned to technological advancements and changing consumer preferences, home-based entrepreneurs can adapt and thrive in this dynamic environment.

Conclusion

Understanding and utilizing the right financial products is essential for anyone looking to launch and sustain a home-based business. These tools not only provide the necessary capital to get started but also support ongoing operations, helping entrepreneurs manage cash flow, invest in necessary equipment, and respond to market opportunities. As the landscape of home-based businesses continues to evolve, the strategic use of financial products becomes increasingly important.

Entrepreneurs are encouraged to seek expert advice to navigate this complex financial landscape. Financial experts like Mikka Montero can provide invaluable insights into the most suitable financial products and strategies for different types of home-based businesses. Their guidance can help entrepreneurs avoid common pitfalls and make informed decisions that align with both their immediate needs and long-term goals.

Additionally, resources such as allthebestloans.com offer a comprehensive platform for comparing different financial products. These platforms allow entrepreneurs to explore various options, from loans to investment tools, ensuring they find the most beneficial and cost-effective solutions. By taking advantage of these resources, home-based business owners can enhance their financial literacy, better manage their business finances, and position themselves for success in an increasingly competitive market.

In sum, the integration of strategic financial planning and expert advice is crucial for the growth and sustainability of home-based businesses. Entrepreneurs should remain proactive in educating themselves and seeking out the best resources to support their business ventures, setting the stage for long-term success and stability.